What is 5G? Your guide to the current generation of wireless communications

It is a capital improvement project the size of the entire planet, replacing one wireless architecture created this century with another one that aims to lower energy consumption and maintenance costs. It’s big talk, but where’s the action?

Here is what 5G Wireless technology is actually about: Making it feasible for telecommunications providers to deliver profitable services over their wireless networks. 4G LTE made running their radio access networks (RAN) too expensive. Compared with 5G, 4G consumes too many resources, requires too much human oversight, and to borrow a phrase best uttered by Ella Fitzgerald, runs too darn hot. The promise of 5G is that it cuts costs.

Realizing this promise means selling consumers and businesses on 5G as an ideal, well before 4G LTE (which ironically stood for "Long-Term Evolution") was originally due to expire. 5G requires a tremendous capital investment, not only in retrofitting existing base stations but also in constructing a denser mesh of smaller, cooler towers, and laying the network of fiber optic cable that connects them. For telcos to afford that investment, they have to sell consumers and businesses on the 5G ideal, well before it can effectively be demonstrated, let alone realized.

They're all pitching a service that has yet to go live. To consumers, 5G is being marketed as a higher quality-of-service option for media-rich, multi-party communications. To enterprises, 5G represents an alternative route to cloud data centers and global business services. Both service classes are being pitched not so much as eventualities as inevitabilities. Several years into the 5G transition already, there remain open questions and unresolved issues. Most importantly, some services with the "5G" moniker are live now, or at least available in some early form, and consumers are searching for that much-promised value.

Also: 5G reinvented: The longer, rougher road toward ubiquity

Big promises collide with bigger realities

The first stage of the 5G Wireless platform is here now, for users of 5G devices in many metropolitan areas. 5G was designed to co-exist with previous generations of wireless communications equipment, particularly 4G LTE. 5G's principal purpose is to enable telecommunications service providers ("telcos") the ability to offer a wider variety of higher-bandwidth services, on newly allocated spectrum. Those services are not available everywhere yet, especially in North America, but the platform is being put in place now. If you use a 4G cellular phone today, it may be operating on a hybrid 4G/5G network at 4G frequencies.

THE SPEED PROPOSITION

The biggest promise of 5G for consumers is this: Media transfer and data transaction speeds comparable to wired Ethernet networks across the country, and at boosted speeds in areas where the topology and service infrastructure support the necessary technology. Once all of 5G's components are fully deployed and operational, you will not need any kind of wire or cable to deliver communications or even entertainment service to your mobile device, to any of your fixed devices (HDTV, security system, smart appliances), or your automobile. If everything works, 5G would be the optimum solution to the classic "last mile" problem: delivering complete digital connectivity from the tip of the carrier network to the customer, without having to drill another hole through the wall.

With so many technologies under the 5G umbrella -- home broadband, office broadband, home television, Internet of Things, in-vehicle communication, as well as mobile phone -- there's no guarantee that, when it comes time, any consumer will choose the same provider for each one unless that consumer is willing to sign a contract beforehand. That's why telcos are stepping up their 5G branding efforts now, including rolling out preliminary 4G upgrades with 5G monikers and re-introducing the whole idea of 5G to consumers as a fuzzy, cloudy, nebulous entity that encapsulates a sci-fi-like ideal of the future.

"We knew it was coming, but it was closer than we realized," explained Verizon CEO Hans Vestberg, speaking during a keynote session recorded for CES 2021 last January -- recorded because of how the pandemic sped up everyone's reliance upon digital connectivity to serve as the world's safety net.

Verizon CEO Hans Vestberg speaking at CES 2021.

(Image: Verizon)"Now, instead of being our future, it's our present," Vestberg continued. "The future of productivity is now the current reality of work. The future of learning is now the current reality of school. The future of mobile payment is now the current reality of banking. And the future of streaming is now the current reality of entertainment."

For telcos; the makers of transmitter, radio, and antenna equipment; and the producers and providers of data networking services, their reality has been this: Customer and enterprise demands on the current wireless network cannot be met with the 4G LTE generation -- perhaps in the near future, and already in countries such as Japan [PDF], several years past. In these densely populated regions of the world, according to operators there, maintaining the equipment that supports 4G and 3G Wireless generates more expenses than they earn in revenue. Service providers desperately need an infrastructure that enables a sustainable business model, through the use of durable, reliable, manageable, affordable equipment. They must meet these new customer demands for quality and availability of service, without succumbing to accelerated technological obsolescence or the unpredictable whims of the global economy.

IF 5G EVENTUALLY SUCCEEDS, WHAT HAPPENS?

The whole point of "Gs" in wireless standards, originally, was to emphasize the ease of transition between one wireless system of delivery and a newer one -- or at least make that transition seem reasonably pain-free. (Not that any transition has ever been a trip to the fair.) 5G entails a set of simultaneous revolutions, all of which would have to go off without a hitch. . . or at least without any further hitches:

- Converged service could lead to converged carriers. In much of the continental US, a consumer's broadband internet provider also has been her cable TV provider. And that relationship is protected by municipally regulated monopolies. 5G wireless aims to level the playing field here, placing AT&T, Verizon, and T-Mobile in competition against Comcast and Charter Communications, both for broadband internet and "cable" television.

- Small cell infrastructure could remake landscapes. To reduce costs for 5G operators, 5G allows for smaller transmitters that consume lower power, but that cover much smaller service areas than typical 4G towers. A carrier will need more of them -- by one estimate, four hundred times more towers than are currently deployed, though conceivably better integrated with the landscape. The expectation is that a 5G small cell could become as common a feature in urban areas as lampposts and graffiti.

- The global technology economy could be reconstructed. Suddenly Scandinavia, home of Finland's Nokia and Sweden's Ericsson, becomes a world power center for telecommunications. And China, whose state-owned China Mobile and state-supported Huawei are jointly responsible for catalyzing 5G architecture, now has one of the most valuable bargaining chips for superpower status it has ever had.

Once complete, the 5G transition plan would constitute an overhaul of communications infrastructure unlike any other in history. Imagine if, at the close of the 19th century, the telegraph industry had come together in a joint decision to implement a staged transition to fax. That's essentially the scale of the shift from 4G to 5G. The real reason for this shift is not so much to get faster as to make the wireless industry sustainable over the long term, as the 4G transmission scheme is approaching unsustainability faster than the industry experts predicted.

Must read:

- BT and Ericsson sign 5G deal as Huawei ban takes shape

- Belgian telcos leave Huawei out in the cold for 5G rollouts

Equipment staged by NTT DOCOMO for 5G urban area trials in Japan.

(Image: Ericsson)5G Wireless use cases

This revolution, like all others, is being subsidized. The initial costs of these 5G infrastructure improvements may be tremendous, and consumers have already demonstrated their intolerance for rate hikes. So to recover those costs, telcos will need to offer new classes of service to new customer segments, for which 5G has made provisions. Customers have to believe 5G wireless is capable of accomplishing feats that were impossible for 4G.

- Driverless automobiles. For a world in danger of spiraling downwards towards losing one million of its species beginning in 2030, you might think the goal of eliminating drivers from moving vehicles would be somewhat lower on the list. But the autonomous vehicle (AV) use case does expose one of the critical necessities of modern wireless infrastructure: It needs to connect people in motion with the computers they may be relying upon to save lives, with near-zero latency.

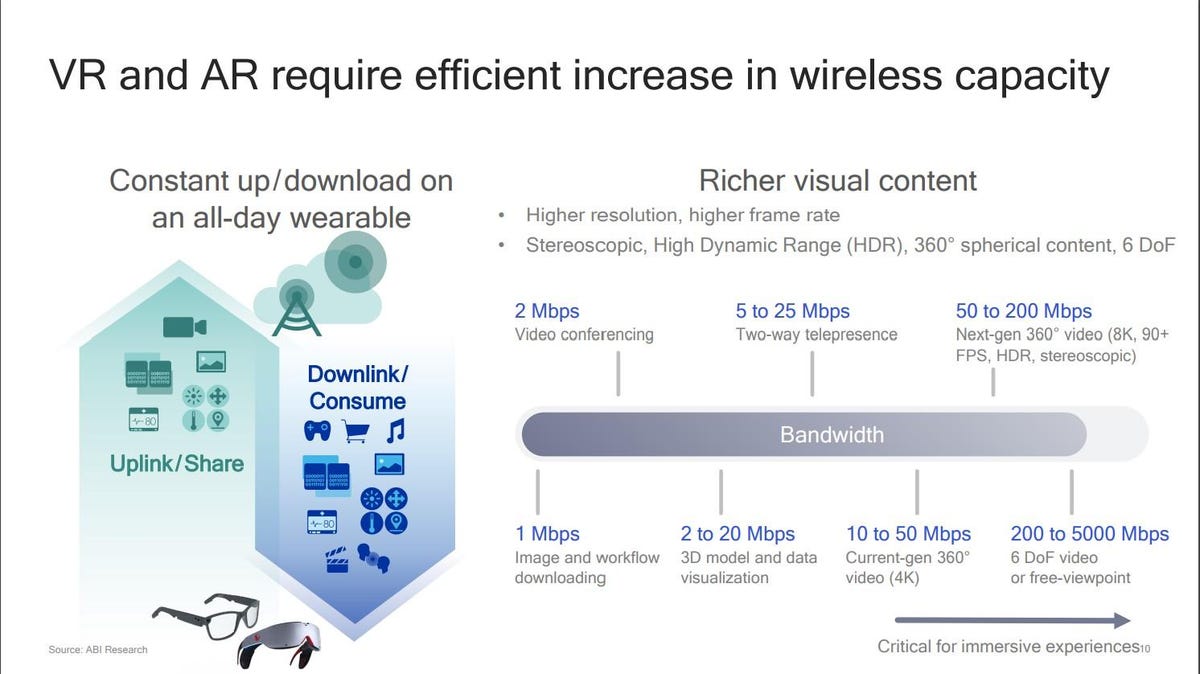

The bandwidth required for a VR application

(Image: Qualcomm)- Virtual reality (VR) and augmented reality (AR). For a cloud-based server to provide a believable, real-time sensory environment to a wireless user, as mobile processor maker Qualcomm asserted in a recent presentation, the connection between that server and its user may need to supply as much as 5 gigabits per second of bandwidth. In addition, the compute-intensive nature of an AR workload may actually mandate that such workloads be directed to servers stationed closer to their users, in systems that are relatively unencumbered by similar workloads being processed for other users. In other words, AR and VR may be better suited to small cell deployments anyway.

- Cloud computing. The internet is not just the conduit for content, but the facilitator of connectivity in wide-area networks (WAN). 5G wireless offers the potential for distributing cloud computing services much closer to users than most of Amazon's, Google's, or Microsoft's hyperscale data centers. In so doing, 5G could make telcos into competitors with these cloud providers, particularly for high-intensity, critical workloads. This is the edge computing scenario you may have heard about: Bringing processing power forward, closer to the customer, minimizing latencies caused by distance. If latencies can be eliminated just enough, applications that currently require PCs could be relocated to smaller devices -- perhaps even mobile devices that, unto themselves, have less processing power than the average smartphone.

- Internet of Things. In a household with low-latency 5G connectivity, today's so-called "smart devices" that are essentially smartphone-class computers could be replaced with dumb terminals that get their instructions from nearby edge computing systems. Kitchen appliances, climate control systems, and more importantly, health monitors can all be made easier to produce and easier to control. The role played today by IoT hubs, which some manufacturers are producing today to cooperate alongside Wi-Fi routers, may in the future be played by 5G transmitters in the neighborhood, acting as service hubs for all the households in their coverage areas. In addition, machine-to-machine communications (M2M) enables scenarios where devices such as manufacturing robots can coordinate with one another for construction, assembly, and other tasks, under the collective guidance of an M2M hub at the 5G base station.

- Healthcare. The availability of low-latency connectivity in rural areas would revolutionize critical care treatment for individuals nationwide. No longer would patients in small towns be forced to upend their lives and relocate to bigger cities, away from the livelihoods they know and love, just to receive the level of care to which they should be entitled. As trials in Mississippi have proven, connectivity at 5G levels enables caregivers in rural and remote areas to receive real-time instruction and support from the finest surgeons in the world, wherever they may be located.

To make the transition feasible in homes and businesses, telcos are looking to move customers into a 5G business track now, even before most true 5G services exist yet. More to the point, they're laying the "foundations" for technology tracks that can more easily be upgraded to 5G, once those 5G services do become available.

"It's not only going to be we humans that are going to be consuming services," remarked Nick Cadwgan, director of IP mobile networking, speaking with ZDNet. "There's going to be an awful lot of software-consuming services. If you look at this whole thing about massive machine-type communications [mMTC], in the past it's been primarily the human either talking to a human or, when we have the internet, the human requesting services and experiences from software. Moving forward, we are going to have software as the requester, and that software is going to be talking to software. So the whole dynamic of what services we're going to have to deliver through our networks is going to change."

Must read:

- What is the IoT? Everything you need to know about the Internet of Things right now

- Will the pandemic map a new course for autonomous cars?

What is 5G really?

If we're being honest (now is always a good time to start), it's incorrect to say that 5G is the fifth generation of global wireless technology. Depending upon whom you ask, and the context of the question, there are really either four or seven generations and only three sets of global standards.

There was never really an official "1G." There were several attempts at standards for digital wireless cellular transmission, none of which became global. The term "2G" is credited to Finnish engineers to characterize the technological leap forward that their GSM standard represented. However, much of the rest of the world used CDMA instead, which was also "2G." So there was never a single, uncontested 2G.

The global standards community came together with 3G and their 3rd Generation Partnership Project (3GPP). It was with the advent of 3G that the world started counting at the same digit. But even for 4G, there were competing standards, and two major groups of practitioners -- one for WiMAX, the other for the victorious LTE -- vying for global supremacy. The 5G effort has, so far, been successful at keeping the engineers together around the same table, contributing towards a single set of goals.

"The first generation of mobile systems that were launched around 1991 -- popularly known as 2G/GSM -- was really focused on massive mobile device communication," explained Sree Koratala, head of technology and strategy for 5G wireless in North America for communications equipment provider Ericsson, speaking with ZDNet. "Then the next generation of mobile networks, 3G, launched starting in 1998, enabled mobile broadband, feature phones, and browsing. When 4G networks were launched in 2008, smartphones popularized video consumption, and data traffic on mobile networks really exploded.

"All these networks primarily catered towards consumers," Koratala continued. "Now when you look at this next generation of mobile networks, 5G, it is very unlike the previous generation of network. It's truly an inflection point from the consumer to the industry."

Huawei's "1+1" passive + active 5G antenna combination

(Image: Huawei)WHO DECIDES WHAT AND WHERE 5G CAN BE

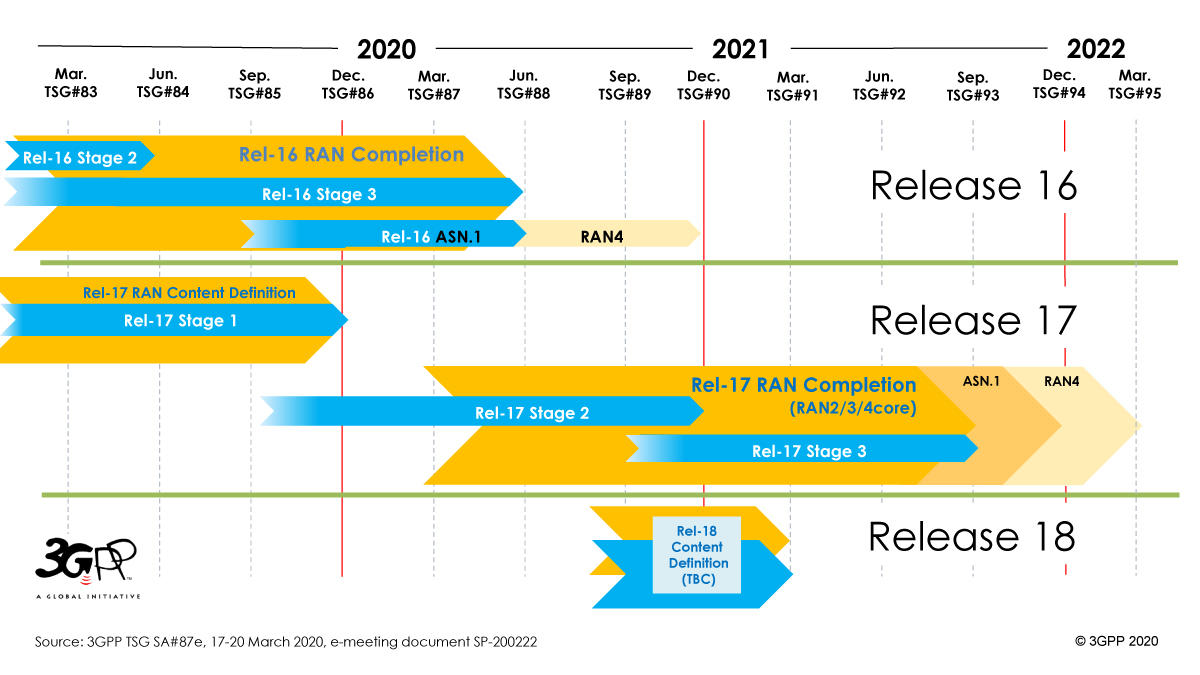

5G Wireless is an explicit set of technologies specified by 3GPP as "Release 15" and "Release 16," and recently, has begun a track for "Release 17." 3GPP is an organization consisting of essentially all the world's telecommunications standards bodies who agreed to share the definition of 3G Wireless and to move on from there to next-generation networks. Today, 3GPP specifies which technologies constitute 5G wireless and, by exclusion, which do not.

The 5G Wireless standard aims to be global -- which is the hard part. Each participating country (e.g., China, Russia, South Korea) or amalgamated body of countries (e.g., the EU, the UN) may operate under its own definition of 5G networks, its own specifications for the 5G New Radio (5G NR) system, its own concepts of 5G speed, and its own regulations for where 5G transmissions may be licensed.

Must read:

DRIVING FOR HIGHER YIELDS

5G is comprised of several technology projects in both communications and data center architecture, all of which must collectively yield benefits for telcos as well as customers, for any of them to be individually considered successful. The majority of these efforts are in one of three categories:

- Spectral efficiency -- Making more optimal use of multiple frequencies so that greater bandwidths may be extended across further distances from base stations (historically, the main goal of any wireless "G");

- Energy efficiency -- Leveraging whatever technological gains there may be for both transmitters and servers, in order to drastically reduce cooling costs;

- Utilization -- To afford the tremendous communications infrastructure overhaul that 5G may require, telcos may need to create additional revenue-generating services such as edge computing and mobile apps hosting, placing them in direct competition with public cloud providers.

SERVICE TIERS

Projection of interrelated 5G service tiers

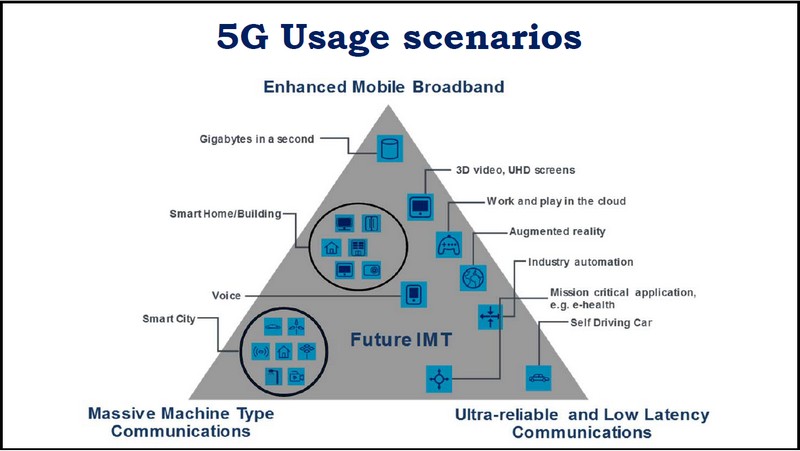

(Image: International Telecommunications Union)It was during the implementation of 4G that telcos realized they wished they had different grades of infrastructure to support different classes of service. With the full adoption of the first complete set of 5G specifications (officially "Release 15") in June 2018, 5G began allowing for three service grades, each of which may be tuned to the special requirements of customers' business models:

- Enhanced Mobile Broadband (eMBB) aims to service more densely populated metropolitan centers with downlink speeds approaching 1 Gbps (gigabits-per-second) indoors, and 300 Mbps (megabits-per-second) outdoors. It would accomplish this through the installation of extremely high-frequency millimeter-wave (mmWave) antennas throughout the landscape -- on lampposts, the sides of buildings, the branches of trees, existing electrical towers, and in one novel use case proposed by AT&T, the tops of city busses. Since each of these antennas, in the metro use case, would cover an area probably no larger than a baseball diamond, hundreds, perhaps thousands, of them would be needed to thoroughly service any densely populated downtown area. And since most would not be omnidirectional -- their maximum beam width would only be about 4 degrees -- mmWave antennas would bounce signals off of each other's mirrors until they eventually reached their intended customer locations. For more suburban and rural areas, eMBB would seek to replace 4G's current LTE system, with a new network of lower-power omnidirectional antennas providing 50 Mbps downlink service.

- Massive Machine Type Communications (mMTC) [PDF] enables the machine-to-machine (M2M) and Internet of Things (IoT) applications that a new wave of wireless customers may come to expect from their network, without imposing burdens on the other classes of service. Experts in the M2M and logistics fields have been on record saying that 2G service was perfectly fine for the narrow service bands their signaling devices required and that later generations actually degraded that service by introducing new sources of latency. MMTC would seek to restore that service level by implementing a compartmentalized service tier for devices needing downlink bandwidth as low as 100 Kbps (kilobits-per-second, right down there with telephone modems) but with latency kept low at around 10 milliseconds (ms).

- Ultra-Reliable and Low Latency Communications (URLLC) would address critical needs communications where bandwidth is not quite as important as speed -- specifically, an end-to-end latency of 1 ms or less. This would be the tier that addresses the autonomous vehicle category, where decision time for reaction to a possible accident is almost non-existent. URLLC could actually make 5G competitive with satellite, opening up the possibility -- still in the discussion phase among the telcos -- of 5G replacing GPS for geolocation.

In July 2020, at the height of the pandemic, the 3GPP organization finalized "Release 16," which includes provisions for:

- Vehicle-to-Everything (V2X) communications, which would incorporate low-latency links between moving vehicles (especially those with autonomous driving systems) and cloud data centers, enabling much of the control and maintenance software for moving vehicles to operate from within stationary, staffed, and maintained data centers.

- Satellite access, which may include the ability for satellite transmission to fill in gaps for under-served or geographically remote areas.

- Wireline convergence, which would finally deliver the outcome that AT&T famously warned Congress was absolutely necessary for the communications industry to survive: The phasing out of separate wireline service infrastructure and the deconstruction of the old telephone lines and circuit-switched networks that were the backbone of the Bell System, and other state-sanctioned monopoly service providers of the 20th century.

Timetables for future 5G-related architecture releases as of April 2021.

(Image: 3GPP.org)Q3 2022 is when 3GPP expects to formalize "Release 17." That's when the real payoff for telcos is expected to take place -- the whole reason they started down this road several years early, while LTE was due to have been in its prime. At last, equipment manufacturers will be able to reliably produce the cost-saving technologies that drove telcos to accelerate their 5G adoption plans in the first place.

First and foremost for Release 17 is a roadmap for moving the radio access network to an entirely bipartite model, where control plane traffic is split from data plan traffic across the board. This enables the scenario where all-virtual components inhabit the control plane, replacing individual components and appliances with virtualized, probably containerized, functions on x86 substrates. This is where 5G architectures part ways with 4G -- where the two can no longer co-exist.

Most notably, 3GPP no longer specifies whether it will be China Mobile's C-RAN architecture that brings this to fruition. This would appear to open the door for O-RAN, the industry's open-source alternative, to step in and potentially neutralize the competitive playing field, at least for one element of 5G infrastructure. While CM has joined the O-RAN Alliance, along with many other China-based firms, quite conspicuously, Huawei has stayed out.

Must read:

- Could 'Open' systems negate Huawei's influence on 5G?

- Here's how C-V2X can change driving, smart cities

5 major players in 5G Wireless

It would be improper to collectively call 5G component manufacturers and service providers an "ecosystem" (even though the attempt is frequently made). An ecosystem is supposed to be self-sustaining. For that to happen, its benefits need to be capable of being reinvested throughout the system. This isn't happening yet for 5G. Even at this late stage, 5G remains something of a gamble.

Whether this gamble pays off depends on the tactics employed by a wide variety of major and minor players, some of which are actually countries, and a few of which in particular are (to phrase it diplomatically) corporations that act on behalf of countries. Here are five principal players worldwide. A few may not be whom you would expect.

CHINA MOBILE

History will eventually acknowledge that the catalyst for the movement away from 4G LTE, and toward a cloud-based radio access network, began with China's state-licensed service provider, China Mobile, Ltd.

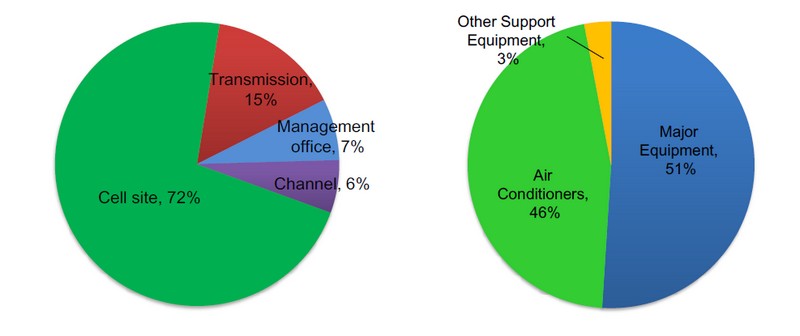

China Mobile's breakdown of its annual capital and operational expenditures for maintaining one 3G base station.

(Image: China Mobile)In 2013, China Mobile conducted a study examining the high costs of maintaining energy-inefficient equipment in its 3G wireless network, which happens to be the largest on the planet in both territory and customers served. The previous year, CM estimated its network had consumed 14 billion kilowatt-hours (kWh) of electricity annually. As much as 46% of the electricity consumed by each base station, it estimated, was devoted to air conditioning. That study proposed a new method of constructing, deploying, and managing network base stations. Called Cloud architecture RAN (C-RAN), it's a method of building, distributing, and maintaining transmitter antennas.

AT&T was an early partner in the experiments emerging from that study, in cooperation with CM. That such a collaboration was not kept secret, despite how Chinese organizations are typically characterized, may have led competitors, and the industry at large, to take the 5G movement seriously.

According to analytics and records firm Statista, CM maintained about 942 million wireless subscribers in all classes at the end of 2020 -- a slight decline from the prior year, making it by far China's largest operator, and probably the world's as well. CM officially participated in China's formal launch of nationwide 5G service on Nov. 1, 2019. As first reported by Light Reading's Iain Morris, the company now claims to have had 93 million 5G subscribers at the end of March 2021, although that number was pared down from 183 million at the end of January, probably after excising customers who were signed up for 5G non-voluntarily.

At any rate, CM probably outpaces the rest of the world in deploying commercial 5G Wireless service. In a way, this makes the company the world's unofficial canary-in-the-coalmine. The whole 5G gamble is about reducing costs over time. That's hard to achieve when the up-front costs for the initial rollout are huge, and amortized over that same time period. So it's not a particularly good sign that CM is estimating it will spend another USD 28.3 billion this year -- two-thirds greater than estimates made just last year -- to continue the rollout at its current pace.

VERIZON

Famously, in 2011, AT&T sought to acquire T-Mobile from parent company Deutsche Telekom, arguably in an effort to consolidate spectrum licenses. Ironically, in a filing last September with the FCC [PDF], AT&T commented, "The combination of Sprint and T-Mobile has resulted in an unprecedented concentration of spectrum in the hands of one carrier." In a recent promotion, evidently designed to rub salt into this open wound, T-Mobile gave away real pink blankets.

While AT&T complained, Verizon acted. In a stunning development last February, Verizon's designated agent placed a winning bid of $45 billion -- more than double what many experts anticipated -- for the broadest swath of midrange, C-band frequencies in the US. The move kept T-Mobile from laying its pink blankets over the lion's share of spectrum and positioning itself as the early 5G victor.

"They feel that they are behind the curve, with respect to T-Mobile," explained Raj Radjassamy, director of 5G product management for telco equipment supplier ABB, "they had to find a way to get things done. The beauty of it is, the whole auction had been nicely planned in such a way that, even though they are going to beat heavily in cash, they can monetize it soon. I think that's what they [Verizon] are banking on."

High-frequency, high-speed service tiers like mmWave may be able to command premium fees from business customers. But that can only happen once all the scientific problems are resolved, and there are plenty still on the table. In the meantime, consumers are perceiving the real 5G payoff -- speed -- as long overdue. Radjassamy believes Verizon, and to a lesser extent AT&T, have put themselves in a position to finally monetize 5G the way everyone was expecting three years ago, by walking away with most of the C-band.

"If they can execute very well, in the next two to three quarters," he told ZDNet, "they'll see the fruit from those risks in a positive way."

Also: T-Mobile, AT&T, and Verizon to duel for 5G enterprise, business subscribers

Overlooked by London's skyscrapers EE's 5G mobile trial kicks off.

(Image: EE)ARM LIMITED

The whole point of software-defined networking (SDN) is to replace purpose-built, bespoke appliances with commercial, off-the-shelf (COTS) computing devices. When SDN first became a topic of interest, folks presumed "COTS" to mean x86/x64-based servers, probably with Intel CPUs.

Arm (formerly "ARM") has long been a factor in low-power computing, but usually for small devices, not general-purpose servers. This has changed in recent years, with the complete takeover of the data center by Linux, and the adoption of distributed computing and workload orchestration. Now COTS does not have to mean x86. With telcos worldwide absolutely requiring their RANs to be deployable on hybrid cloud platforms, supported by rugged, low-power infrastructure, Arm now has a windfall opportunity to supply its licensee partners with the designs and platforms they'd need to literally re-sculpt the computing architecture of the planet.

Also: Arm processors: Everything you need to know now

HUAWEI

Probably no one with an active stake in the success of 5G Wireless truly believes the world would be better if all countries hoarded their own intellectual property like empires once again. But some of these stakeholders are in countries whose leaders appear not to really care.

Up until the end of the last US presidential administration, the country's official 5G policy began, pretty much on line 1, with the vilification of Huawei, including literally and directly affiliating the company with the Chinese Communist Party. In February 2020, the United Kingdom and the European Union appeared to decide to align their anti-Huawei policies, limiting Huawei's access to their markets to just the network core. Then last July, in a reversal that would have been stunning had it been made in any other year, the UK completely changed its tack against Huawei's 5G initiatives, giving individual EU nations a wide berth to follow suit.

China responded by doubling down on its commitments to roll out domestic 5G services, as part of its so-called Digital Silk Road (DSR) initiative. With China having been among the first nations to emerge from the pandemic and rebuild its economy, all indications are that DSR had a smooth launch. If that is indeed the case, then 5G's fate could be determined by an intellectual property battle, with two or perhaps even three global trading blocs effectively forking their own versions. While that may bolster China's self-image, it may not necessarily be a good move for Huawei, still the world's leading producer of 4G and 5G telecom equipment, which would benefit just as much as any other producer in this industry from 5G Wireless remaining a single, global platform. This year will reveal where Huawei's true loyalties lie.

Also: 5G unmade: The UK's Huawei reversal splits the global telecom supply chain

RELIANCE JIO

India is among the countries most devastated by the pandemic, both culturally and economically. In its overcrowded metropolitan areas, people are absolutely dependent upon smartphones, or at least feature phones that were sold to them as smartphones. Yet in terms of wireless coverage -- of deploying transmitters that grant cellular devices access to wireless networks -- to this day, India has never really experienced a "G" the way the rest of the world has. Sure, there are smartphones throughout India whose status bars light up with "4G" icons. But quality of service has fluctuated so greatly, from one city block to another, that it's debatable whether India's service can be called a "standard."

What's more, perhaps tens of millions of the country's active 4G smartphones were at least half-subsidized by Mukesh Ambani, the world's 13th richest man according to Bloomberg, and the chairman and founder of what's now India's largest carrier, Reliance Jio. Through colossal discounts and service plans whose prices began at free, Ambani essentially created his carrier's customer base single-handedly.

Last March, Reliance Jio -- as expected -- was the winning bidder in India's auction of some 490 MHz of mid-band spectrum. There's an argument to be made that, had Jio never come into existence, there would have been no auction. Now, with Ambani having made a personal promise to launch 5G service throughout India in the second half of this year, Jio has another miracle to pull off.

When China Mobile first conceived 5G's mesh of smaller, cooler, lower-power transmitters and base stations, it didn't just have China in mind. 5G may be feasible for India in ways that 4G LTE could never be. Today, however, India is deeply wounded by the pandemic, as well as politically polarized by leaders who still deny the pandemic's power. India's telcos have trusted Huawei, though its leaders trust the US -- whose position on Huawei does not appear to be changing. It's now up to Jio to make India into 5G's greatest success story before it becomes a wireless no-one's-land.

Also: Wider net: 5G and the connection between the wireless connections

How sustainable will 5G be this time?

In May 2017, AT&T President of Technology Operations Bill Hogg declared the existing wireless business model for cell tower rental, operation, and maintenance "unsustainable." Some months earlier, a J. P. Morgan analyst characterized the then-business model for wireless providers in Southeast Asia as unsustainable, warning that the then-current system has rendered it impossible for carriers to keep up with customer demand. And as research firm McKinsey & Company asserted in a January 2018 report, the growth path for Japan's existing wireless infrastructure is becoming "unsustainable," rendering 5G for that country "a necessity."

One senses a theme.

The world's telcos need a different, far less constrained, business model than what 4G has left them with. The only way they can accomplish this is with an infrastructure that generates radically lower costs than the current scenario, particularly for maintaining, and mainly cooling, their base station equipment.

Cooling and the costs associated with facilitating and managing cooling equipment, according to studies from analysts and telcos worldwide, account for more than half of telcos' total expenses for operating their wireless networks. Global warming (which, from the perspective of meteorological instrumentation, is indisputable) is a direct contributor to compound annual increases in wireless network costs. Ironically, as this 2017 study by China's National Science Foundation asserts, the act of cooling 4G LTE equipment alone may contribute as much as 2% to the entire global warming problem.

THE WORLD'S BIGGEST 5G USE CASE

One of the hallmarks of China Mobile's C-RAN cell site architecture is the total elimination of the on-site base band unit (BBU) processors, which were typically co-located with the site's radio head. That functionality is instead virtualized and moved to a centralized cloud platform, for which multiple BBUs' control systems share tenancy, in what's called the baseband pool. The cloud data center is powered and cooled independently, and linked to each of the base stations by no greater than 40km of fiber optic cable.

An Ericsson 5G transmitter used in NTT DOCOMO's Japan trials.

(Image: Ericsson)Moving BBU processing to the cloud eliminates an entire base transmission system (BTS) equipment room from the base station (BS). It also completely abolishes the principal source of heat generation inside the BS, making it feasible for much, if not all, of the remaining equipment to be cooled passively -- literally, by exposure to the open air. The configuration of that equipment could then be optimized, like the 5G trial transmitter shown above, constructed by Ericsson for Japan's NTT DOCOMO. The goal for this optimization is to reduce a single site's power consumption by over 75%.

What's more, it takes less money to rent the site for a smaller base station than for a large one. Granted, China may have a unique concept of the real estate market compared to other countries. Nevertheless, China Mobile's figures show that rental fees with C-RAN were reduced by over 71%, contributing to a total operational expenditure (OpEx) reduction for the entire base station site of 53%.

Keep in mind, though, that China Mobile's figures pertained to deploying and maintaining 3G equipment, not 5G. But 5G NR was designed with C-RAN ideals in mind, so that the equipment never generates enough heat to trip that wire, requiring OpEx to effectively quadruple.

Must read

- Wider net: 5G and the connection between the wireless connections

- We could lose the 5G race to China, warns US Department of Defense

The big gamble

You will hear from many sources that 5G is not about what anything is, but rather what it enables you to do. No, it isn't. 5G is about the things in which the telecom industry, and to a growing extent the data center networking industry, must invest in order to produce the latest editions of platforms such as V2X and mMTC, so that it can start earning revenue from those services. 5G is all about what it is.

If you end up watching smoothly streaming 4K video on a new class of smartphone, allowing yourself to be ferried between cities in an otherwise unoccupied vehicle, or participate in a virtual, real-time football tournament with a few dozen goggle-wearers scattered throughout the planet, then you will be fulfilling the hopes of telco engineers who hope to make 5G viable. The truth is, none of these consumer technologies are the real reason 5G is being engineered. Indeed, they are the side benefits.

Three experimental AT&T cell tower designs for desert deployment. (Yes, they're right in front of you.)

(Image: AT&T)5G is a collective bargain between the telecommunications industry and society. To allow for anything close to evenly distributed coverage over a metropolitan area, the base stations containing the transmitters and receivers (the "cells") must be smaller, much lower in power, and much greater in number than they are today. Essentially, the new cell towers must co-exist with the environment. An outdoor photograph taken in any direction will be just as likely to include a 5G tower as not. (The example above, provided by AT&T, includes three.)

It would not be unprecedented in history. We've borne telephone and electric poles through our neighborhoods and, not all that long ago, willingly installed TV aerials the size of kites on our chimneys. Some of us still use their old mounting posts for our satellite dishes. In exchange for the hopefully minor blemish on our landscapes that 5G may bring, many would wave a cheerful goodbye to dead spots.

All these things must happen, and in relatively quick succession, in order for telcos to afford the infrastructural overhaul they now have no choice but to make.

EXPLORE FURTHER -- FROM RV:

- 5G and edge computing: How it will affect the enterprise in the next five years by Scott M. Fulton, III

- Has 5G made telecommunications sustainable again? :Status Report by Scott M. Fulton, III

- 5G: These are the countries winning the race right now by Daphne Leprince-Ringuet

ELSEWHERE:

- Huawei, 5G, and the Eastern 'new normal' that is already underway by Martin Banks, Diginomica

- Edge Computing: AT&T Says the Edge Isn't Where You Think It Is by Scott M. Fulton, III, Data Center Knowledge

- Questions about America's next big midband spectrum auction by Mike Dano, Light Reading

No comments:

Post a Comment